Soybean Marketing Tips

By Bruce Barker

Where do you spend your time – marketing or agronomy?

The June 2018 soybean market was a perfect example of how soybean growers can profit from timely pricing. Over a three-week period, soybean prices dropped almost two dollars per bushel. That’s roughly equivalent to losing five bushels per acre due to a production problem.

Know the market

On the supply side, soybeans are being produced and traded globally 12 months of the year. The two big players are South America and the United States. The critical periods for production estimates are September through March in South America and May through October in the United States.

Weather, especially during planting and pod filling can play a critical role in how many soybeans are produced. So, it is not surprising that the market tends to rally during these critical periods. The difference of two to three bushels per acre across many millions of acres can have a large impact on the markets.

On the demand side, China is responsible for almost two-thirds of global soybean imports, followed by the EU at 10 per cent. China has been known to buy the equivalent of the entire Canadian soybean exports in a two-week time frame.

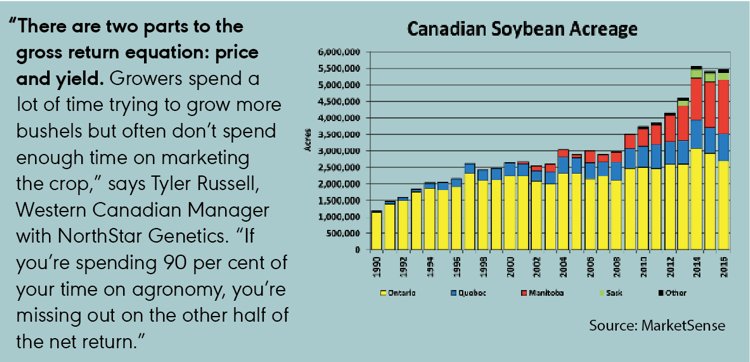

“There is a tremendous amount of room for growth in Canadian soybean production. We can increase acreage in Western Canada by a significant amount and still find markets for them,” says Russell.

Western Canada has extremely limited domestic crush so the Chinese market is very important. Some beans are trucked to U.S. crushers in the Northern Plains but as Prairie production has increased, soybeans are more commonly moving by rail to export markets off the West Coast to Asia.

Prairie soybeans are in direct competition with soybeans grown in the Dakotas and shipped through U.S. ports on the Pacific Northwest. Rail shipments to these Canadian and U.S. Pacific ports are more expensive than barge freight down the Mississippi River to the U.S. Gulf. As a result, most U.S. soybeans are exported via the Gulf.

However, immediately following the U.S. harvest, Gulf traffic can be congested. This is before the South American crop is available, so buyers will look to ports on the Pacific including Vancouver and Prince Rupert for their soybean supply.

“Effectively, this means that some of the best opportunities for Prairie growers to move soybeans through the West Coast will be between the end of October and January. Once the South American harvest begins, buyers will turn back to that market,” says Russell.

Investigate who is buying soybeans in your area. In Manitoba, most major grain companies are buying soybeans throughout the year. There are also smaller crushing plants and brokers who purchase soybeans direct from farmers.

In Saskatchewan, most of the major grain companies are buying soybeans, but Russell still encourages growers to do their homework and find out who is buying soybeans, when they are accepting delivery and shipping them, and what types of contracts they offer. This should help answer questions around soybean storage requirements or potential cash flow options. Having a plan is always better than guessing after the fact.

Execute the plan

Russell says the biggest risk factor in marketing soybeans is not spending enough time planning and executing. There are over 10 different grain contracts that a farmer can use to maximize his net price. Here are a few different contracts to consider:

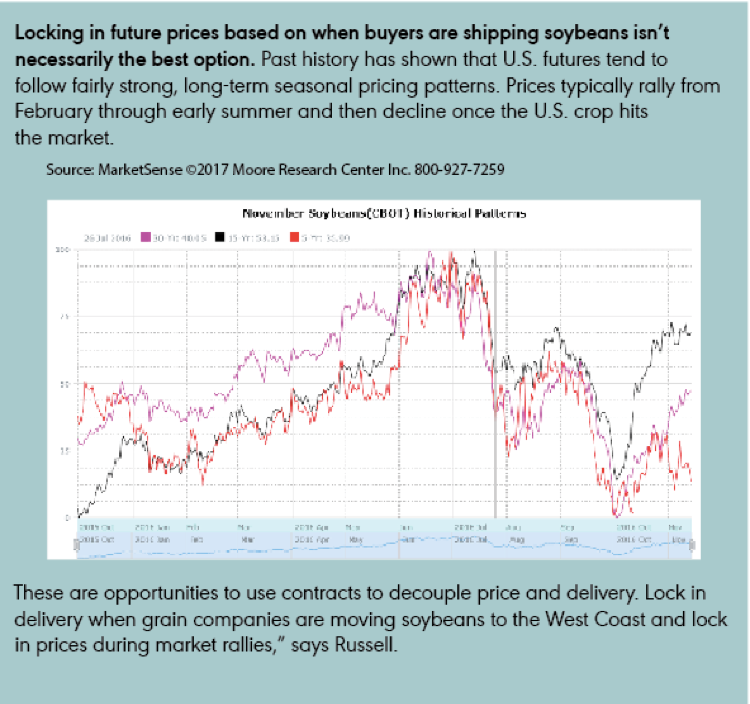

1) Flat Price / Deferred Delivery – Consider forward pricing soybeans in April/May to take advantage of seasonally high futures prices for October/November delivery or forward contracting into the future to take advantage of carry in the market.

2) Fixed Basis – If the CBOT futures are trending upward, consider locking in delivery space with a basis contract and pricing the futures at a later date.

3) Minimum Pricing – Locks in a floor price when you deliver soybeans, but offers upside potential if the futures continue to trend upwards.

4) Averaging contracts – Averages the futures over a defined period of time.

“It is good to have some bullets to market throughout the year. A production issue or surplus in the U.S. or Brazil can really move the markets,” says Russell. “Everyone is happy to grow another five bushels per acre, but executing a marketing plan to take advantage of seasonal rallies should be just as satisfying.”